I would like this e mail included in the general public comments section of the upcoming Land Use meeting as I am unable to attend in person.

I have taken the time to read the agenda for the upcoming Land Use Meeting, and every public comment submitted on every item on the agenda.

What I find appalling and glaringly consistent is not only the lack of public comment entered in the record on these items, but the fact that in spite of the public comments that are received in total opposition, these measures are consistently approved.

We have already brought to the county’s attention that the current system of public information on rezoning changes may adhere to state guidelines, with obscure little yellow signs and legal notices in newspapers no one reads, but is inconsistent with the county’s own policies, process and procedures, not to mention inadequate use of the county website, “Citizens Advisory Commitees”, “Neighborhood Registries” and of course “social distancing” while battling a dual “health crisis” of a pandemic and don’t forget, “racism”.

In our current concerns about “Sunshine Laws”, consider this. I believe this state requires a 30 day public notice. But when the county publishes a notice and places a small sign on a property, but cannot see fit to put it on a pending agenda at the same time, nor publish the documents associated with the item for public review, you have denied us our rights to full disclosure, transparency and adequate time to respond intelligently.

When an item on the agenda has no public comment, our county staff is not doing its job for the people that pay their salaries and getting that information to the public.

When items on the agenda are consistently approved by our BOCC in spite of public comment in opposition, you are not representing your constituents as you were elected to do.

When our BOCC is laden with a suspicious public due to our contentious elections and obvious bias toward their campaign sponsors, its time for all to step back and rededicate yourselves to helping us help you, help us.

When our BOCC has been asked repeatedly to consider, at the minimum, a rezoning moratorium, in order not only to address the inadequacies of the system, but also to direct our attention to the “health crisis”, our infrastructure, our phosphate industry and our economy, and yet consistently ignores any issues brought up by citizens to be put on the agenda, you have silenced the voices a few months ago passionately campaigned for you with great hopes.

We can be better than this, require public input before anything comes before the board. Our county staff needs to have an incentive and methodology to work for us as hard as they do for the applicant paying those fees. We need a true Citizens Advocate to level the playing field in a quasi judicial system where ordinary citizens must face a litany of well paid and well connected “experts” and legal teams. The Commissioners have a “County Attorney”, the citizens do not.

We need a BOCC with the integrity to admit that without the developers dollars and party affiliations, they would not be sitting in those seats on the dais, but behind the podium for three minutes of abject frustration.

We need a BOCC with the integrity to admit that for the most part, they are leading a woefully uninformed and uneducated public. Where is the honor and integrity in that? A dog can be trained to herd sheep.

By all rights and purposes, the county probably has violated “Sunshine Laws” by posting legal notices but not following through with posting the items on the agenda in the same time frame.

Nope, just one citizen that has taken the time to actually read and compile a statistical analysis of our county commissioners and staff activities over the last few years. Numbers don’t lie. We spend an inordinate amount of time on items pertinent to an elite few, and ignore public sentiment and common sense.

Redeem yourselves. Listen to the people and consider the advantages and the sense it makes to promote just a rezoning moratorium at this time.

At the very least, you should all recuse yourselves from voting on any measures on this current agenda until it can be ascertained by our Inspector General (hahaha) that proper protocol and procedure has been followed, which we have already proven and brought to your attention on just one item that it has not.

There are six “Constitutional Amendments” on the ballot for the November election. We agree with the League of Woman Voters of Manatee County in voting YES on Number 2 only and NO on the other five. Number 2 deals with Raising Florida’s Minimum Wage.

We also agree with the LWV on the Manatee County Bond Referendum on "Water Quality Protection, Fish and Wildlife Habitat Preservation, and Park Ad Valorem Tax and Bonds". Vote For Bonds

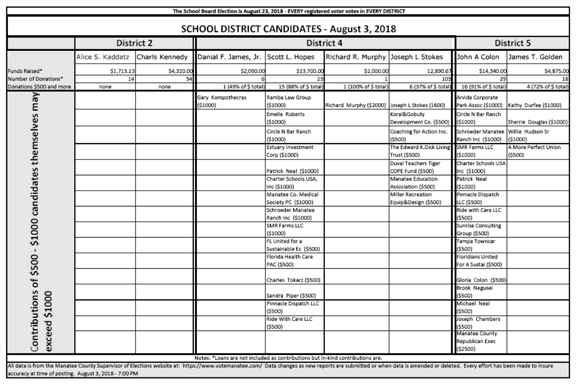

Click this link: Local candidates with huge campaign contributions (Big Money) usually indicate support by an organization that will benefit financially if their candidate is elected. If voters are undecided, “Our Manatee” recommends not voting for Big Money candidates who, if elected, generally do not act in support of taxpayers and common citizens.

The Supervisor of Elections website, by law, has to list candidate names and amounts of all contributions. You can identify Big Money candidates by looking at the total contributions for each candidate in any given race. For example: one candidate for District 3 Commissioner has raised $10,755.00 while the other has a total of $108,381.80 (Almost $100K more!!!). We recommend voting for the candidate with the smaller amount (Matt Bower).

Click this link to see the list of candidates along with total contributions:

https://www.votemanatee.com/Candidate-Information/Local-Candidates-Committees

If contributions are similar in any race, we recommend reading candidate information online in the Bradenton Times.

On Thursday, February 6, 2020 (9:00 AM start) at the Land Use Meeting of the Manatee County Board of Commissioners, Carlos Beruff is asking for removals of two of the Stipulations that were part of his approval.

It is in our BEST INTEREST to be present at this meeting and make it known that these STIPULATIONS are an insurance policy, if you will, that will enable us to know the density and intensity of the buildings and provide us with a first hand visual of their impact on the shoreline and surrounding area and require additional approvals to continue.

As Commissioner VonHahmann notes if this is accepted by the Board, our Public Voice will be silenced and we will be taken out of the loop and agreements by Carlos are broken. We must voice our opinion and

OPPOSITION.

We must be prepared to deny Carlos and the Board from taking away this one small piece of security that we have as citizens on this project as it moves forward.

Please attend this important meeting on February 6, 2020, post it on Facebook and share it with your email/other lists.

The Agenda will be posted on January 30, 2020 and more information will be sent out as to time and format. Meanwhile, mark your calendars.

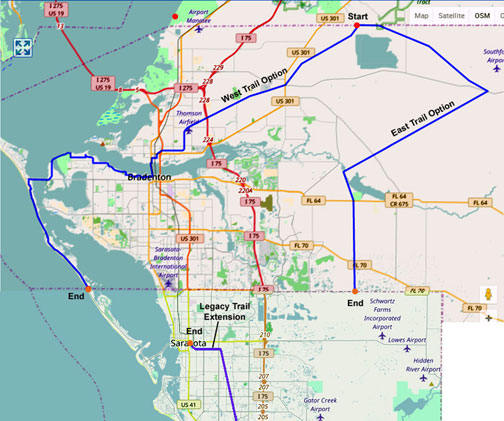

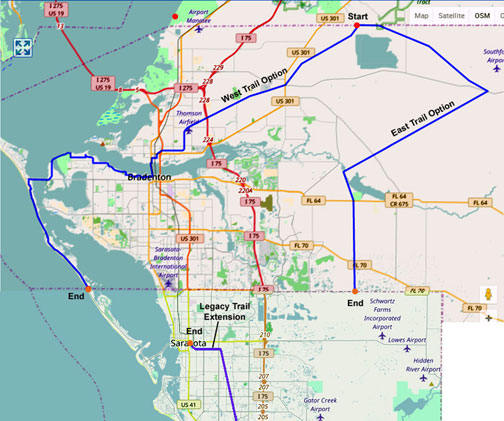

Manatee County received a $511,000 SUN Trail grant from FDOT for a short section of the multi-use SUN Trail along Erie Road near the new high school. In a memorandum from the Director of the Parks & Natural Resources Department, Charlie Hunsicker stated, “Unfortunately, the initial field investigation and design work has determined that the impacts to wetlands would require millions of dollars more to complete construction along this specific segment.” So, without a formal study, the county gave the grant money back to the state.

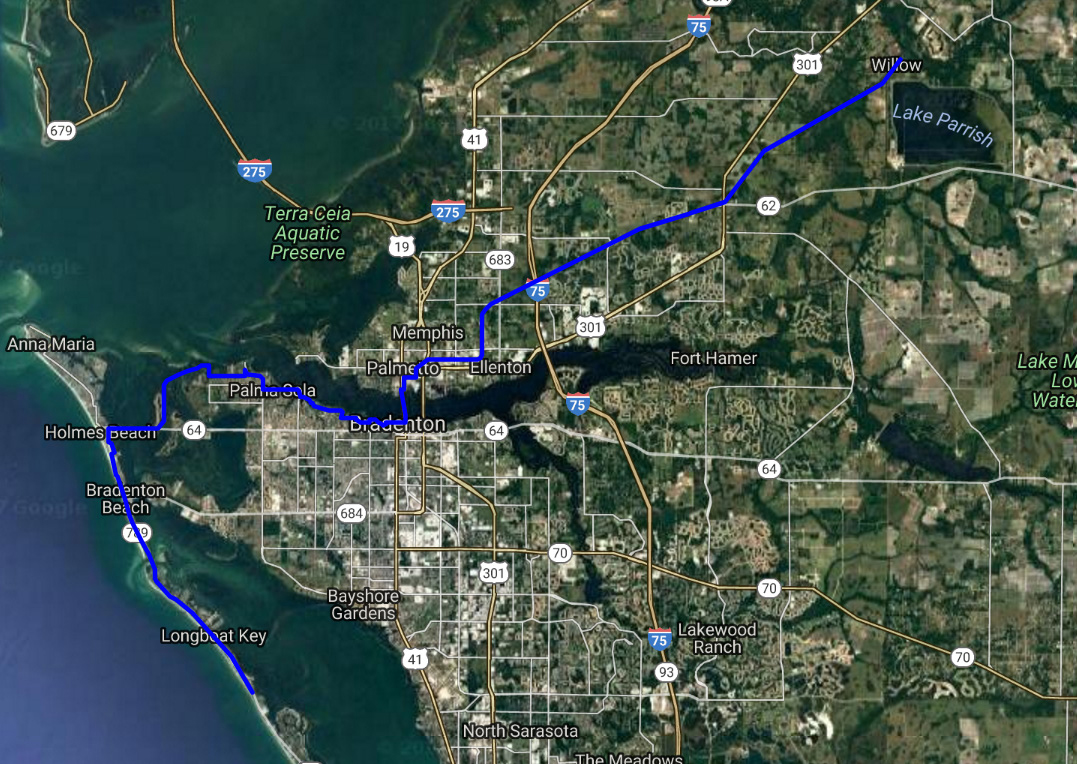

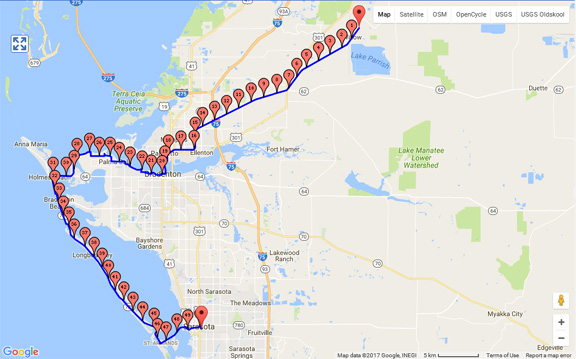

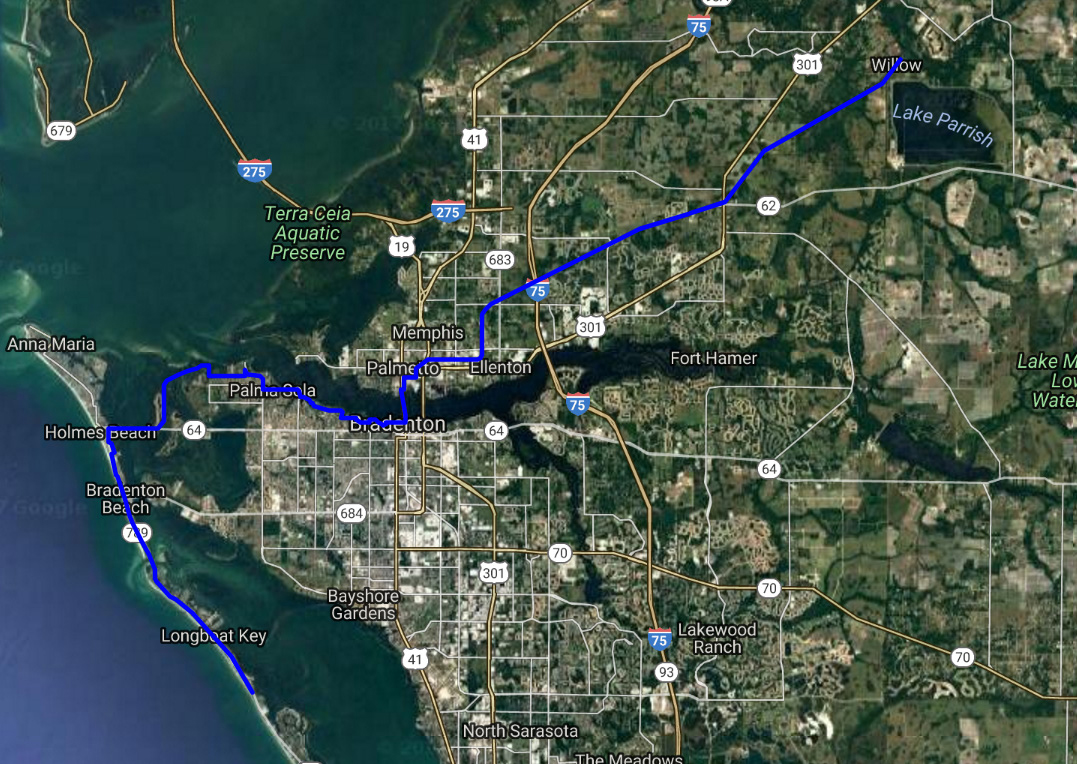

Plans have been in place for many years for the trail to follow the CSX/FPL railroad right-of-way from Willow (near the Hillsborough County line) to Palmetto. FPL agreed to allow the FREE USE of its 100’ wide right-of-way for the trail. The tracks are used only occasionally and are 5’ wide which leaves 95 feet for the multi-use trail which is planned to be 12 ft. wide. There would never be less than 40 ft. on one side or the other of the tracks for the trail to stay within the right-of-way. No land would have to be purchased.

Hunsicker mentioned, “Another portion of the SUN Trail, the Gateway Greenway, is under development with SMR (Lakewood Ranch developers). The current plan is to construct a multi-use path as part of the proposed Bourneside Blvd., connecting University Parkway to SR 64 in east county.” That would require the purchase of a large amount of private property and construction of two long bridges over major highways (SR64 and SR70) at approximately $3M each. Clearly this would cost millions and millions of dollars for the land alone and even if the land were donated by the developers, they could demand inflated credits to offset impact fees which are already discounted millions of dollars per year. The railroad, western route, requires NO BRIDGES over major roads, thus making it much less expensive than the SMR eastern route,

After a thorough review of the railroad right-of-way using Google Maps, Manatee GIS Server, and, Google Earth including historic imagery plus live on the spot checks we found NO wetlands that would be impacted within or near the railroad right-of-way thus no unusual mitigation would be required. However, we did find new or planned developments (opposite each other) on both sides of the railroad right-of-way that have common ownership.

Some have speculated that eventually the railroad will sell the right-of-way at bargain-basement prices possibly to the developers who could combine land on both sides of the tracks.

We believe the bottom line is that SMR developers want the SUN Trail to go over their land because multi-use trails near homes increases their value significantly and SMR could sell land for the trail to the county at inflated prices. Any multi-use trail through SMR property would cost several times more than a trail on the FREE railroad land through Parish and Palmetto and the western route would serve more people and provide more safety for citizens of Manatee County. Palmetto, Holmes Beach, and the City of Longboat Key have already made plans and spent large amounts of taxpayer and grant money in anticipation of the SUN Trail going their way soon. In addition, Sarasota is planning to connect the Legacy trail to the SUN Trail on Longboat Key in the near future.

It appears that the developers convinced the county to return over a half-million dollars in grant money because it would be cheaper to build the SMR route which clearly is not true.

The Federation of Manatee County Community Associations, Inc. (FMCCA) endorses the western route for the SUN Trail and suggests that impact fee revenue be used to construct an eastern route since it would only be needed because of new development.

One year ago, the BoCC approved ORDINANCE 18-07 which caps collection of impact fees at 90% of the amount recommended by the State of Florida mandated impact fee study. The ordinance states in part: "WHERE AS, it is in the best interest of the public health, safety, and welfare of Manatee County to amend Section 1102.3.A of the Impact Fee Ordinance to cap impact fees at the current level of ninety percent (90%) of the impact fees set forth in the adopted Impact Fee Schedule to facilitate a strong economic climate in the County and to assure the continued legal defensibly of the County's Impact Fee Ordinance and impact fees, while also providing sufficient funding for capital facilities needed to accommodate new development."

The problem is that this is not a true statement and it was never proven to be true before the ordinance was approved. How can taking $3,650,000 out or our county budget over the past year to pay for infrastructure required ONLY because of new development be "in the best interest of the public health, safety, and welfare of Manatee County"? No proof of this was ever given nor was there ever any proof that the Impact Fee Schedule produced by the State of Florida mandated study was in error.

This ordinance was initiated by developers for developers and is not in the best interest of the taxpayers of Manatee County and should be rescinded unless there is irrefutable proof that the people of Manatee County benefit by paying $3.65M for developer required infrastructure. Where is the proof?

The Federation of Manatee County Community Associations (FMCCA) or just “The Federation” as it is often called, is a public service organization that was founded in 1964 to assist home owners and their organizations (HOAs, Condo Associations, and other residential organizations) with legal and other issues that concern those groups or their members.

Over the past 55-years the FMCCA has assisted countless individuals with issues they have with their owners’ associations and conversely, those associations with problems with the local and state governments, developers, property issues, and numerous other concerns. And, this is all done without cost to those receiving advice from the Federation.

In addition, the Federation hosts public meetings every month (except summer) open free to the public. Generally, the meetings consist of a presentation by individuals of interest to the general public. Recent meetings have hosted candidates for various offices, elected officials, police representatives, public employees, and others who have specific knowledge about issues concerning home owners.

The Federation is non-partisan and does not endorse candidates or promote any political agenda. It does provide input to various governmental organizations at the local and state level and encourages legislation that promote the health, welfare, and safety of the people of Manatee County and visitors.

The Federation strives to promote integrity in government. It is a watchdog of Manatee County. We speak as our members’ representatives.

We are always seeking new individual and association membership. The dues paid by each association or individual member is minimal, 50 cents/member of an association up to 100 (no extra charge over 100 members so $50 maximun) or $10 for an individual. The Federation website may be found at: http://www.thefmcca.com

Robin DiSabasino, former County Commissioner, will be the speaker at our next public meeting on January 15th (Tue.) . Meetings are held at the First Baptist Church in downtown Bradenton, 1306 Manatee Ave W, Bradenton, FL 34205. Turn north (toward the river) on 14th Street and park behind the church. Walk south between the two church buildings to the doors (left building) to the meeting rooms. Meetings start at 6:45 PM Everyone is welcome, free!

To contact the Federation email to: fmccasupport@aol.com

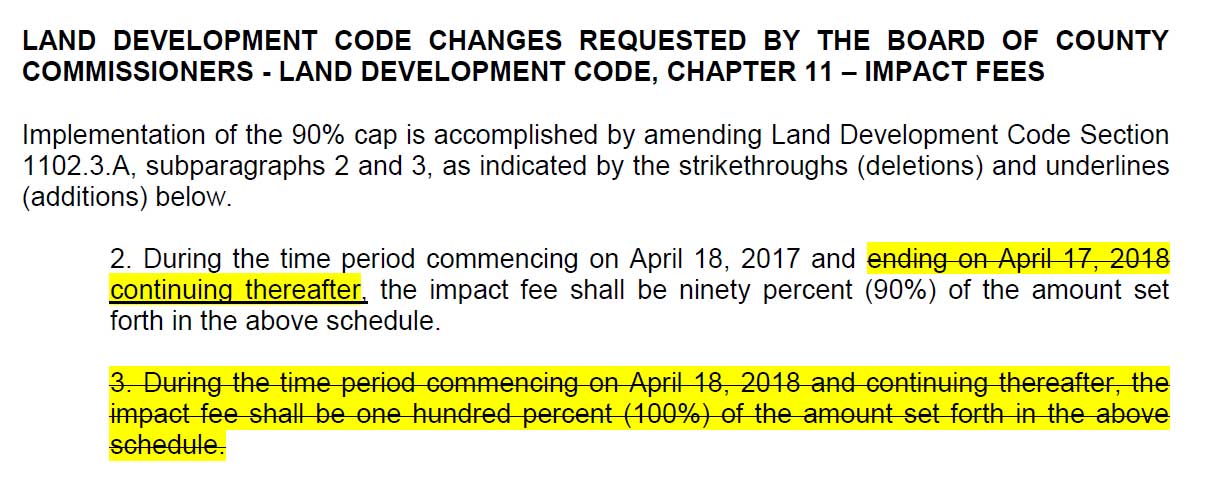

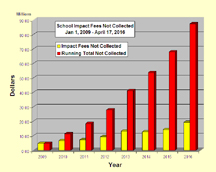

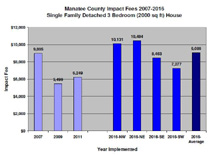

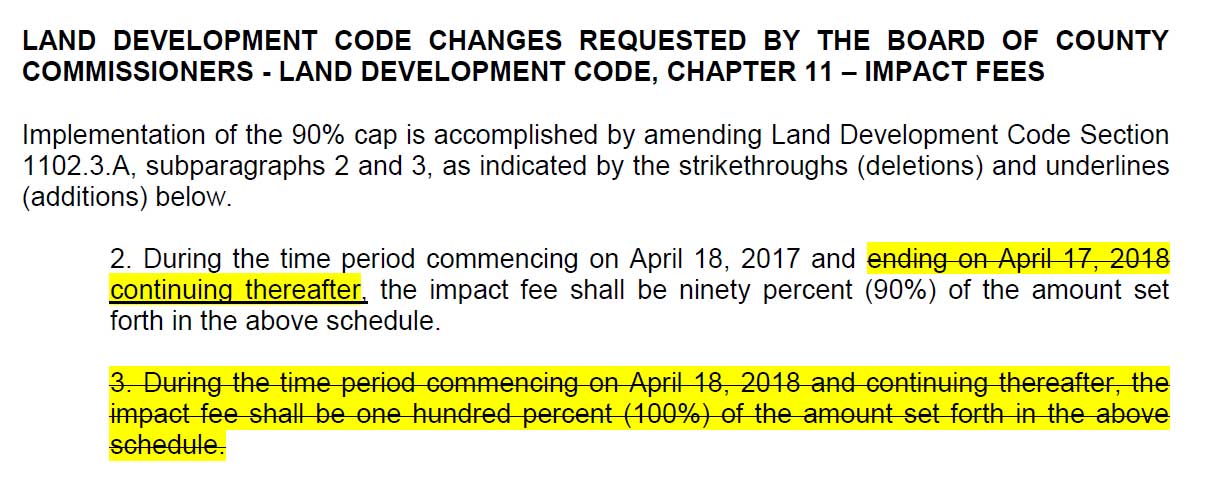

Last March the Board of County Commissioners amended the Land Development Code to cap collection of Impact Fees at 90% starting April 18th instead of going to 100% as previously scheduled.

That means that the County is not collecting enough impact fees to pay for the infrastructure that is required to support new development as determined by the TishlerBise Impact Fee Study. It has been suggested by at least one county official that if enough funds are not collected, the needed infrastructure is just not provided. You can imagine how the developers would react if the county didn’t provide required roads, or fire protection, or police patrols, and other services that require infrastructure needed by new development.

It has also been suggested that if the developers don’t get an impact fee discount, they will sue the county and legal fees will cost the county huge amounts of money. First, since when has the county been in the business of paying protection? Second, there would have to be some legal reason for the developers to sue the county which there is not. TischlerBise, the company that did the impact fee study has done over 900 impact fee studies and has NEVER been sued successfully. There is no reason to believe that TishlerBise would do anything that would jeopardize their stellar reputation. Fourth, representatives of the developers have suggested that jobs would be lost if they had to pay 100% because they would have to raise the price of their houses which would result in fewer sales. That is nonsense. The developers are selling record numbers of houses and they can’t find enough workers as it is. Also, the added cost would be less than $1 per day on a 30-year mortgage which would never deter a buyer of a $250,000 or more house. People move here because of the climate and beaches, not because they can save a dollar a day on a new house. And fifth, the county population is exploding. Growth is out of control. Traffic congestion is ridiculous because there isn’t enough revenue to improve existing roads because we are giving the developers millions of dollars and tax increases can’t keep up.

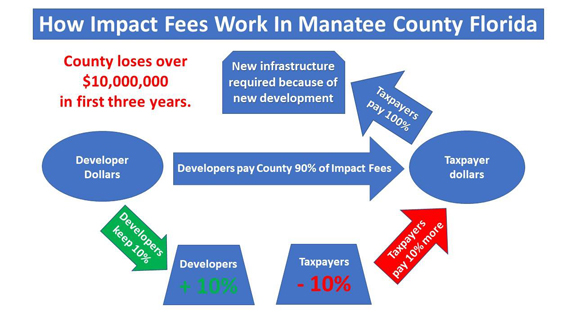

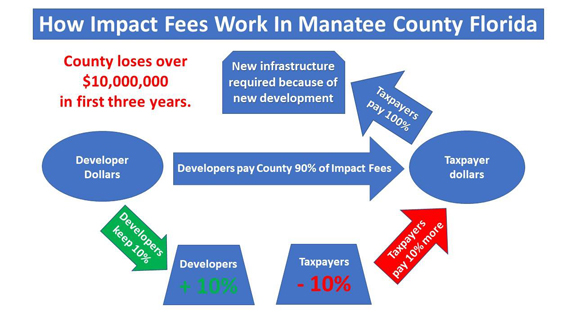

The fact is, our tax dollars are used to buy 10% of the required developer necessitated infrastructure to the tune of $10,000 per day, every day even on weekends and holidays for an annual total of $3.65-million or over $10-million tax dollars over the first three years.

The Land Development Code is very specific in regard to amending that code. It clearly indicates that any amendment to the Land Development Code must be “in the best interest of the public health, safety and welfare of Manatee County”. The capping of impact fees clearly is not in the best interest of the people of Manatee County. In fact, using tax dollars to pay for infrastructure necessitated ONLY because of new development is “misappropriation of public funds” which is a criminal offense and should be halted immediately, all tax dollars already expended under the terms of ORDINDNCE 18-07 as amended should be refunded and returned to the Manatee county treasury, and those responsible should be indicted.

The point is, we don’t want our tax dollars subsidizing the developers and we don’t want our quality of life declining because of that. The Brookings Institution agrees. Based on a study they did, communities that collect full impact fees prosper more than those who don’t. The county should collect the full impact fee the developers owe. If county officials refuse to make the developers do that, to pay for infrastructure required because of new development, they should be indicted for misfeasance.

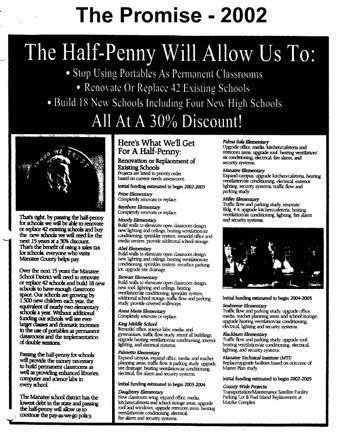

For the sake of our students and your pocketbooks, every registered voter should PATRICIPATE in the AUGUST ELECTION/PRIMARY.

We have seen what happens when voters vote straight party-line in elections at all levels. We often don’t get what we expected as powerful interest groups have hijacked our political system for their own benefit and at the expense of the common citizen. That is not the way Democracy is supposed to work but when voters abdicate their responsibility to understand what candidates stand for, we often get unexpected “representatives” elected.

$10,000.00 PER DAY

THAT IS HOW MUCH THE COMMISSIONERS ARE GIVING THE DEVELOPERS

BY NOT COLLECTING 100% OF THE RECOMMENDED IMPACT FEES

April 25, 2018

On March 20th, four of our commissioners (Whitmore, Benac, Bough, Smith) voted to amend the Land Development Code (illegally) to cap impact fees at 90% of the amount recommended in the TischlerBise impact Fee Study. This will cost taxpayers over 10-million-dollars over the next three years. That is $10.0000.00 per day. And now they are talking about increasing taxes.

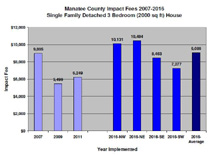

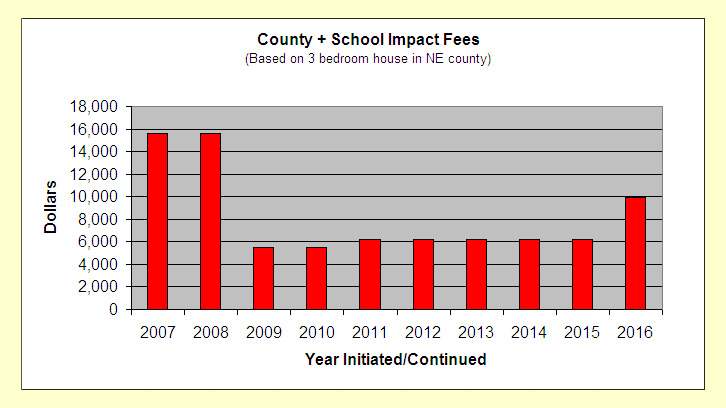

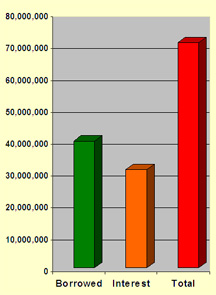

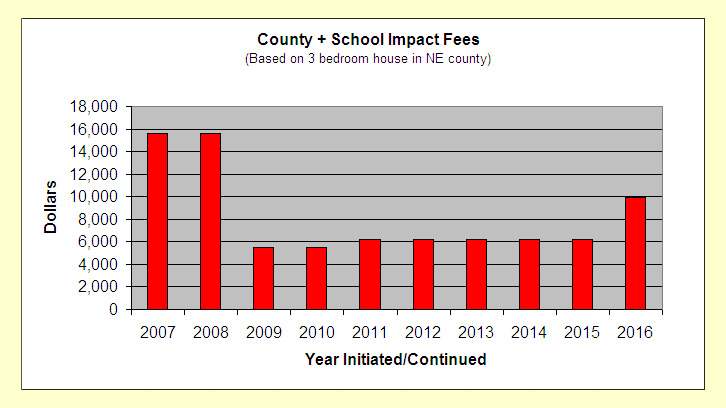

The chart below shows how Manatee County taxpayers are forced to pay 10% of the developers impact fees. Just think about the good uses that noney could be put to instead os subsidizing the wealthy developers. Think about that when you vote in November.

Click on chart for a large printable image.

THE TRUTH ABOUT MANATEE COUNTY

IMPACT FEES AND FACILITY INVESTMENT FEES (FIFs)

April 15, 2018

Manatee County impact fees are based on an “Impact Fees Study” done by a reputable firm that specializes in doing such studies. The most recent study done for Manatee County and the Manatee County School District was done by TischlerBise, Inc. at a cost of $171,000 (+50K for the schools). TischlerBise has done over 900 impact fee studies all over the U.S. and Canada. Although some of those  studies have been challenged by developers, none has ever been successfully challenged. That means that the impact fees set by those studies are accurate. There is no reason to believe that the impact fees charged by Manatee County aren’t also accurate.

studies have been challenged by developers, none has ever been successfully challenged. That means that the impact fees set by those studies are accurate. There is no reason to believe that the impact fees charged by Manatee County aren’t also accurate.

As per the State of Florida Impact Fee Act, impact fees pay for “infrastructure necessitated by new growth”. The TischlerBise Study covered both school infrastructure and county infrastructure.

School infrastructure includes new schools that are needed only because of new development and capital expenditures for infrastructure that would not be required except for that new development. Existing residents will not benefit from that infrastructure and should not have to pay for it. School impact fees pay for school buildings themselves, land on which the schools are built, school buses for those schools, athletic fields including spectator stands, storm drainage systems around the schools, classroom equipment for science labs, computer labs, technology/occupational shops and more. School impact fees are currently collected at the impact fee study recommended rate, 100%.

The TischlerBise 2015 County study (an update of their 2013 study), included capital expenditures for infrastructure necessitated for Law Enforcement, Public Safety, Multimodal Transportation, Parks & Natural Resources, Libraries, and Administrative Services. County impact fees are presently collected at the 90% rate and were scheduled to go to 100% on April 18th. On March 20, 2018 the Board of Commissioners voted, without justification, to cap county impact fees at 90%. That means that the County (the taxpayers) will have to absorb the other 10% which amounts to over $10-million over the next three years.

There are two categories of impact fees in Manatee County: residential and nonresidential. Residential rates are determined by the size of living space in square feet (per residence) and the location of those structures within the county. Nonresidential rates are based on size in square feet and the type of structure (10 types) such as manufacturing, nursing home, office & other service, and lodging).

There are also “Facility Investment Fees” (Ord. 6-88, 10-70, and 15-22) in Manatee County which include water, sewer (wastewater), and fire service. “..consultants retained by the county have recommended amendments to certain provisions of Article VIII of Chapter 2-21…” “The County retained the services of Public Resources Management Group, Inc., and McKim & Creed Engineers P.A., to prepare a report entitled “Manatee County, Florida, Water and Wastewater Facility Investment Fees” Dated July 27, 2006 (“Facility Investment Fees Study”)…” It further states, “The Facility Investment Fees established in this article are based on the facility investment fees study and additional calculations by the staff.”

FIFs are less well-known fees and do not fall under impact fees in Manatee County. In some other Florida counties water, wastewater, and fire services are included under impact fees. Ordinance 15-22 suggests that current facility impact fees (FIFs) are based on a twelve-year-old study (partially updated in 2015) plus “calculations by the staff”.

Impact fees require an annual audit while nothing is said in Ordinance 15-22 about an audit for FIFs. Information stated here suggest that water, wastewater, and fire service should be included with Impact Fees and that Facility Investment Fees may be grossly under charged (because part of the study is 12 years old) and should be investigated by an independent outside authority.

The cap on county impact fees was approved without justification which is contrary to the Manatee County Land Development Code. This should also be investigated by an independent outside authority.

BY GIVING $10,000,000 TO THE DEVELOPERS THE

BOARD OF COMMISSIONERS PROVE THEY DON'T REPRESENT US

April 10, 2018

Land Development Code Ordinance 18-07 was approved by the Board of commissioners on March 20, 2018. That is an amendment to the LDC which April 18, 2018 allows the impact fee rate to stay at 90% instead of going to 100%. That change, over the next three years, will cost the taxpayers of Manatee County at least 10-million-dollars.

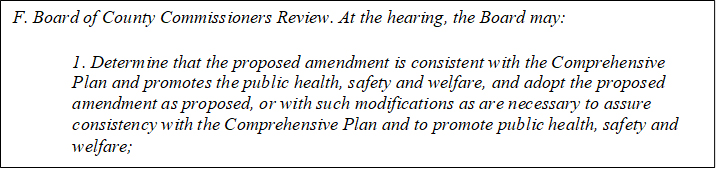

The amendment provisions of the LDC (Section 341.2.F) specifically state:

Board of County Commissioners Review. At the hearing, the Board may:

1. Determine that the proposed amendment is consistent with the Comprehensive Plan and promotes the public health, safety and welfare, and adopt the proposed amendment as proposed, or with such modifications as are necessary to assure consistency with the Comprehensive Plan and to promote public health, safety and welfare;

2. Refer the matter back to the Planning Commission for further consideration; or

3. Determine that the proposed amendment is not consistent with the Comprehensive Plan or does not promote the public health, safety or welfare, and deny the proposed amendment.

Clearly the Board chose option 1 indicating that they believe that the amendment promotes public health, safety, and welfare. We think using $10M tax dollars to pay for infrastructure required only because of development is not in our best interest and does not “promote the public health, safety or welfare”.

In fact taking $10M out of our tax revenue precludes using it to improve our safety, health, and welfare. For example, the Sheriff has publicly stated that he needs 50 more deputies. Using those tax dollars to hire at least some of those officers would promote our safety and welfare and making sure our first responders had adequate NARCAN kits could prevent overdose deaths, In fact there are hundreds of uses for those tax dollars that put it to better use than giving it to the developers.

Those Board members who voted for the developers instead of the people of Manatee County clearly do not represent us the taxpayers and citizens of Manatee County. In fact, what they did is contrary to the amendment provisions of the LDC and likely unlawful. We have already contacted the State of Florida’s Attorney General’s Office for clarification.

And, while we are on the subject, who requested that this amendment to the LDC be considered by the BoCC? We know it came out of a workshop session but a Freedom of Information Act request of meeting notes did not include the names of those who brought up the topic for consideration. Do you think that was an oversight or intentional?

The bottom line is that we cannot trust our Board of Commissioners to do the right think. With an election coming up in November one issue needs to be forefront, impact fees. How do the candidates stand on impact fees? There is no valid reason why we should support any candidate for either the Board of Commissioners or the School Board who does not favor collection of 100% of the recommended impact fees.

Vote them out!!!

COMMISSIONERS VIOLATE LAND DEVELOPMENT CODE

March 25, 2028

The Board of Commissioners voted last week to have county taxpayers, pay 10% of the developers’ impact fees. No justification was given by the four commissioners who voted to take over ten-million-dollars out of our county revenue, over the next three years, and use it to pay for infrastructure that is required only because of new development.

After giving developers discounts on impact fees since 2008, they were scheduled to end on April 18th but that all changed with the Board vote to amend the Land Development Code and vote to cap impact fee collection at 90% thus continuing the impact fee discount indefinately.

The Land Development Code (LDC) has specific rules for amending the Code. It States:

At no point during the hearing did any member of the Board mention how amending the Land Development Code to cap collection of impact fees at 90% (Ordinance 18-07) promotes the public health, safety and welfare. They did not, and they could not, because they cannot justify their vote. They should therefore immediately rescind their vote and allow the rate of impact fee collection to go to 100% as stipulated by LDC Section – 1102.3 prior to this amendment.

IMPACT FEES MUST BE PAID IN FULL BY THE DEVELOPERS

An Open Letter to the Board of Commissioners and the People of Manatee County

March 14, 2018

If impact fees are capped at 90%, it will cost the County more than $10-million over the first three years. That figure is based on the impact fees actually paid during fiscal year 2016-2017 which was $24,117,181.61 (from Freedom of Information request). That amount was collected at the 80% and 90% rates. 80% from Oct. 1, 2016 through April 17, 2017 and 90% from April18, 2017 through Sep. 30, 2017. Click HERE for full calculation.

By calculating the 100% amount for each of those two periods and adding them together, we got the total amount that would have been  paid during FY 16-17 if impact fees had been collected at the 100% rate. That works out to $28,623,075.04. In other words, the developers saved $4,505,893.47 because of the reduced collection rates during FY16-17.

paid during FY 16-17 if impact fees had been collected at the 100% rate. That works out to $28,623,075.04. In other words, the developers saved $4,505,893.47 because of the reduced collection rates during FY16-17.

While the developers saved over $4.5M that fiscal year, the county lost that same amount because it had to provide 100% of the infrastructure necessitated by new development to meet “concurrency” requirements and the “level of service” in the rest of the county and not just the 90% the developers paid for. Providing less or inferior infrastructure is not an option. That means that $4.5M had to be taken out of the county’s other revenue and was not available for projects that would directly benefit taxpayers.

If impact fees had been capped at 90% during FY 16-17, the shortfall would have been $2.86M (not $2M as suggested in the Planning Commission meeting and which was based on older data).

Impact fees during this FY (2017-18) are being collected at the 90% rate but are scheduled to increase to 100% on April 18th. If they are capped at 90% the cost to the county will be in excess of $3M. That takes into account expected increased growth and inflation and will continue to increase every year. If impact fees are capped at 90%, the county can expect to spend over $10M in the first three years to compensate for non-payment of 10% of the recommended impact fees by the developers.

That is $10M out of our county revenue that can't be used for projects such as road repair and improvements, low-cost housing, more emergency vehicles such as police cars and fire trucks, sidewalks, and many other projects that will go underfunded or unfunded if the developers are not required to pay for all of the infrastructure that is necessary only because of their new development.

The bottom line is that the developers are selling record numbers of houses and are making record profits. Manatee County, on the other hand, has not fully recovered from the "Great Recession". The Sheriff, for example, recently reported that he was short 50 officers and even if he had them he doesn’t have the patrol cars to accommodate them. The Public Works Department does not have enough funding to construct sidewalks needed so citizens don't have to walk or ride bicycles on busy roads. The county is struggling to find funding for indigent care and for affordable housing, repair or replace deteriorating infrastructure, and much more.

It just does not make sense to use much needed county revenue to pay for infrastructure that is required only because of new development, especially when the developers are making record profits and they could pass impact fee costs on to home buyers.

Section 341 of the Land Development Code addresses "LDC Amendments". Paragraph 341.2.F states in part that, in order to approve an amendment to the LDC, the Board of Commissioners must, "Determine that the proposed amendment is consistent with the Comprehensive Plan and promotes the public health, safety and welfare...". The amendment to cap impact fees at 90% does not meet that test.

Taking over $10M (over three years) out of the county revenue to pay10% of the impact fees of private companies is not in our best interest and does not "promote public health, safety and welfare". Using those funds for projects that directly benefit the people of Manatee County as mentioned does meet that test and does not violate Section 341 of the LDC.

The developers will argue that capping impact fees will allow them to sell houses for less thus increasing sales. They have used that argument before but there is no proof that they ever reduced the prices of their houses or even built more houses when impact fees were discounted. It is well known that prices of house are “market driven”. If the developers can get more for each house, they will. If sales are slumping they may reduce prices regardless of impact fees.

They will also argue that when they sell more houses, the tax base increases. That is true but it is well known that property taxes do not fully pay for the services the county provides to each home. That means that the county actually loses money for every new house built. And, since a “cost of services study” has not been done in Manatee County in over 30 years, the cost to the county is doubtless much higher than costs based on a thirty-year-old study. However, it should be noted that future tax receipts have no bearing on the cost of infrastructure required by new development so the developers’ assertion is not even relevant.

There is also no proof that lower impact fees create more jobs. With unemployment rates at the lowest level since 2000, there is a shortage of employees and considering that most of the house construction in north of I-75, many employees come from other counties where they live, spend their money, and pay their taxes which has no positive impact on Manatee County.

At previous hearings, some developer representatives have referred to impact fees as “unfair taxes”. Impact fees are not unfair and they are not taxes. Impact fees may be used only to provide infrastructure that is necessitated because of new development. Impact fees pay for roads, emergency vehicles, parks, libraries, and a multitude of other infrastructure that is needed only for new development and does not benefit the rest of the county. Impact fees are not taxes and anyone who calls them taxes at a hearing is misinformed or if knowingly misrepresenting them as taxes, risks serious legal consequences if under oath.

Some have suggested that buyers of older homes didn’t have to pay impact fees but they neglect to note that there are roads, parks, schools, and other infrastructure in those areas that were funded by the original owners and those costs are included in the price of those homes.

Unlike taxes, fees are used to pay for specific services or physical materials that directly benefit the fee payer. Impact fees are a cost of doing business just like the cost of plumbing, electric wiring, windows, and roofs. They are required for each home. Imagine what a home would be like if it didn’t have a roof. Likewise, imagine what a house would be like if there were no roads leading to it or no fire station nearby in the event of a fire.

The State of Florida passed the “Impact Fee Act” because communities were going broke providing infrastructure for new developments. It isn’t fair to make the county pay for that infrastructure or even part of it. Impact fees should be paid by the developer and passed on to the home buyer as part of the cost of each house. Why are developers complaining if they are doing that?

Impact fee rates are set by Impact Fee Studies that are required by the Impact Fee Act. TishlerBise, Inc. did our last study at a cost of $171,000. TishlerBise has done over 900 Impact Fee Studies all over the nation and has a stellar record of never being successfully sued for not recommending accurate impact fee rates.

The developers are likely to “hint” that they will sue the County if Impact Fee rates go to 100%. They know that there would be no basis for a lawsuit since they were free to have input as the study was being conducted and again after the new county sales tax was approved but, they have threatened to sue before. Some, including our own county lawyers, may suggest that the cost of a lawsuit would be prohibitive to the county. First, the probability would be extremely low considering TishlerBise’s stellar record and, second the cost of a lawsuit would be dwarfed by the loss of over $10,000,000 over the first three years if the 90% cap is imposed or $5,000,000 if a 95% cap is approved. There should be no gift of capping Impact Fees for the developers. They are having record sales and record profits while the County has still not fully recovered from the “Great Recession”.

Studies show that counties that collect impact fees at 100% prosper more than those that don’t (Brookings Institution). I therefore respectfully request that you vote "NO" on "ORDINANCE 18-07 LAND DEVELOPMENT CODE TEXT AMENDMENT/CONSIDERATION OF IMPACT FEES AT 90%" or any other rate less than 100%.

Sincerely, Ed Goff

COUNTY UNDER-COLLECTED NON-RESIDENTIAL IMPACT FEES

March 3, 2018

In a “memorandum” to the County recently obtained through a Freedom of Information request, we learned that the County “mistakenly” did not collect over $2M in non-residential impact fees between October 11, 2011 and October 31, 2016.

Non-Residential or Commercial impact fees are calculated manually, unlike other impact fees which are computed automatically. The  memo from the Clerk of the Circuit Court and Comptroller was an “Impact Fee Revenues Follow-up Audit” and reviewed a sample of only 269 commercial permits from a total of 2,192 using “statistical and judgmental sampling”. Exceptions were found in impact fee assessments in 33 (12.27%) of the permits tested. All were undercharges. No overcharges were reported. It is not known if there were errors in the other 1,923 permits!

memo from the Clerk of the Circuit Court and Comptroller was an “Impact Fee Revenues Follow-up Audit” and reviewed a sample of only 269 commercial permits from a total of 2,192 using “statistical and judgmental sampling”. Exceptions were found in impact fee assessments in 33 (12.27%) of the permits tested. All were undercharges. No overcharges were reported. It is not known if there were errors in the other 1,923 permits!

Management has taken corrective action including hiring an additional employee, moving the function, organizationally within the County to allow for direct reporting to the Infrastructure & Strategic Planning Official, and the Financial Management Department will conduct quarterly reviews of the manual impact fee assessments. An impact fee consultant has also been contracted to revise the Impact Fee section of the Land Development Code.

So, what about the detected $2M+ of undercharges and the other 1,923 permits that weren’t in the “sample”? Well, “Management does not intend to pursue the collection of any under-assessed impact fees. It is their belief that once permits have been approved and issued, the County is obligated to honor the impact fee assessments at those amounts.”

It looks like the taxpayers lose again. Nothing was said about legal action or what happened to the employees who were responsible for those “mistakes” that always favored the developers.

WHO SHOULD PAY THE DEVELOPER'S IMPACT FEES?

February 20, 2018

On January 4th we wrote to the Manatee County Impact Fee Administration Office requesting information about impact fee collection. A number of citizens had asked us how much money 10% of Impact Fees represents. If Impact Fees were capped at 90% how much  would the county have to pay to make sure the developers have the infrastructure they required for their developments?

would the county have to pay to make sure the developers have the infrastructure they required for their developments?

We received an immediate response form manager Dwaine Guthrie who seemed to want to help. His email was also copied to John Osborne, Elaine Barker, and Kathleen Thompson. Over the next several weeks we exchanged emails with various county employees who referred us to others or told us to be more specific about exactly what we wanted. These emails clearly were efforts to prevent us from getting the information we had requested in our first email.

Finally, we were referred to Debbie Scaccianoce at the public records office. We were directed to the “Public Records Requests” website but didn’t have an account so we requested one and were able to access the totally inadequate website where we made a number of requests for information. That was on January 30th. We made one request and seven more on February 5th. None have been answered as of this writing, Feb. 20th.

We feel that the county is in violation of the Freedom of Information Act and the Florida Sunshine Law. We are now working with a lawyer gathering information for possible action.

Finally, from a different source, we were able to get one of our requests answered. We were told that the Manatee County collected $24,117,181.61 in Impact Fees for fiscal year 2016-2017 which started on October 1, 2016 and ended on September 30, 2017. This amount does not include any credits the developers may have received for infrastructure they provided, “donated” land, or other allowable credits.

Our goal was to calculate the amount of Impact Fees that would have been collected if the developers had been charged 100%. Since the rate of collection changed from 80% to 90% on April 18, 2017 we used the number of days it was at each rate (199 days and 166 days) to estimate the proportion that was collected at each rate. That came out to $13,148,687.414 and $10,968,494.196 respectively. By dividing these amounts by the rate in effect when they were collected we were able to get the 100% amounts for each period (80% and 90%). By adding those values together, we got $28,623,075.04 as 100% of the amount that could have been collected for FY16-17.

At the Planning Commission meeting on Feb. 8 one of the commissioners asked what 10% represented in dollars and was told 2M-dollars. Our figures indicate 2.86M-dollars based on 100% collection last year. Assuming increased construction and inflation we suggest that 10% this year will be in excess of 3M-dollars which will only increase over the next three years starting on April 18th (the date the collection rate is scheduled to go the 100%). We therefore conclude that over a three-year period it will cost the county over $10,000,000 if impact fees are capped at 90%.

So, what does all this mean? Well, first it means that last FY the developers paid $4.5M less than the recommended 100% which means that our tax dollars made up the difference. It also means that if the Board of County Commissioners decide to cap impact fees at 90% even though the developers are having record sales and record profits, we tax payers will have to make up the difference which will amount to over $10M over the next three years.

Just think what could be done with that money. Streets could be repaired, safety improvements could be made, help with indigent care, qualify of life could be improved, etc. We are sure the commissioners could think of a multitude of ways to spend that money rather that give it to the developers who are already making record profits.

The fact is that Ordinance 18-07 (capping impact fees at 90%) is contrary to the Land Development Code Section 341.2.F.1 which states that the Board of Commissioners may “Determine that the proposed amendment is consistent with the Comprehensive Plan and promotes the public health, safety and welfare, and adopt the proposed amendment as proposed, or with such modifications as are necessary to assure consistency with the Comprehensive Plan and to promote public health, safety and welfare;”

Clearly using $10,000,000 to pay for infrastructures that the developers (private companies) should pay for does not “promote the public health, safety and welfare” of the people of Manatee County and therefore, is not in compliance with the provision for amending the LDC.

Please contact your commissioner and come to the public hearings on March 1st and/or 20th to voice your opinion on this issue. The developers have not paid their share for over ten years which has severely hurt our county. It long past time for them to pay their fair share.

THE

DEVELOPERS CAN’T AFFORD TO PAY IMPACT FEES

January 15, 2018

It would seem that the developers are having financial problems since they have asked the County to cap the collection of impact fees at 90%. Of course, they will probably argue that the impact fee study done by TishlerBise, Inc. was flawed, and they will sue the county if impact fees are finally returned to 100% on April 18th for the first time since 2008. The most recent discounts were approved by the  Board of Commissioners on December 3, 2015 with Ordinance 15-43. The new rates recommended by the TischlerBise study went into effect on April 18, 2016, giving the developers a 20% discount of the recommended rates. That discount was reduced to 10% last April 18th and is scheduled to go 0% on April 18, 2018. That is why the developers are in such a twit. In the over nine years since 2008, they have gotten accustomed to keeping a portion of the impact fees they legally owe and they don’t like paying what they owe,

Board of Commissioners on December 3, 2015 with Ordinance 15-43. The new rates recommended by the TischlerBise study went into effect on April 18, 2016, giving the developers a 20% discount of the recommended rates. That discount was reduced to 10% last April 18th and is scheduled to go 0% on April 18, 2018. That is why the developers are in such a twit. In the over nine years since 2008, they have gotten accustomed to keeping a portion of the impact fees they legally owe and they don’t like paying what they owe,

The 1st public hearing concerning this issue is scheduled for February the 8th Planning Commission meeting. The Board of Commissioners will meet on March 1st and March 20th concerning the issue with the vote taking place on April 5th. There is little doubt that we will hear from the usual multi-millionaires, Pat Neal and Carlos Beruff, about how thin their profit margin is and how they provide hundreds of jobs to local workers. We’ll probably also hear from Rex Jensen, Schroeder-Manatee Ranch CEO, who will argue that we need to encourage economic development to be competitive with other counties. He won’t mention the traffic congestion caused by uncontrolled over-development or the deterioration of existing infrastructure, neglected because of lack of funding or the lower quality of life in Manatee County, as compared to other counties.

We’ll probably also hear from some local sub-contractors who were “encouraged” to go to the hearing by the developers. They will say that impact fees are unfair taxes that reduce how much they can pay their employees even though the developers are very kind and fair and always pay them fairly and promptly. Someone from the community will inform them that impact fees are NOT TAXES and that communities that charge impact fees prosper more than communities that don’t. (Brookings Institute and others)

We’ll likely hear from County Administrator, Ed Hunzeker, who will reiterate how he ”has never transferred property taxes into the Capital Improvement Program to pay for infrastructure” but will neglect to say that $100M in infrastructure bonds issued by the county are paid back including interest with tax revenue, including property taxes and sales taxes, which we all have to pay.

Ed Vogler, omni present developer attorney, will hint lawsuit without mentioning the term while giving praise to the commissioners who are “doing a wonderful job” and who he knows will do the right thing for everyone especially the developers who have given so much to the county.

There will be the usual back and forth among the commissioners. Betsy Benac (aka “developer puppet”) will claim that the impact fee study is not exact, it is not a science, it is just an estimate and if it is wrong, Our legal fees to defend 100% collection of impact fees will be huge. We are better off capping them at 90% to insure the developers don’t sue us. She will ignore the fact that TischlerBise, Inc. has NEVER lost a challenge to any of the over 900 impact fee studies they have done all over the nation. The probability that they made a mistake in Manatee County is 0%. Not being one to give up easily, she will probably suggest a 95% cap which is probably what she actually wanted anyway.

Some of the other commissioners will be in favor of 100% impact fee collection. These include DiSabatino, Smith, and probably Whitmore who is up for election in November. Benac will favor a discount although she’ll try to make it look like she is wavering. That is part of the game. You have to find out how the other commissioners are going to vote before you make a commitment. She wants to vote for a discount but will only do that if there is a question of it passing.

Whisenant Trace is still somewhat unknown. She is a thinker and will see through the developer’s rhetoric. She’ll weigh the pros and cons; but in the end, we think she’ll side with the taxpayers, even though the developers may withhold funding if she runs for re-election. The voters, on the other hand, are likely to reward her for doing the right thing. Jonsson could hold the swing vote. Generally, he goes with the majority; but if that is not obvious, we think he’ll side with the developers.

Whatever the vote, it’s likely to have a long-term effect. It is a change to the Land Development Code (LDC) which is permanent for all future impact fee studies. It could represent hundreds of millions of dollars that the developers will not pay even though the impact fee studies recommend that is what they owe.

Ideally, the impact fee rate would be set at 100% permanently. If there is any valid reason why the developers shouldn’t always pay what they own, we would like to know what it is.

THE DEVELOPERS WANT OUR TRAIL

October 22, 2017

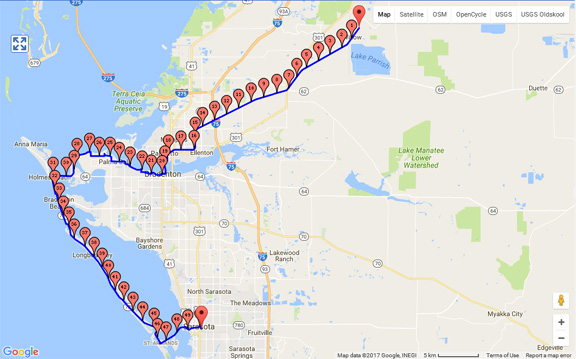

Florida Greenways and Trails wants the SUN Trail to run through Manatee County and the State is putting up $25-million per year, shared among all the counties, to fund grants for this project. Unlike bicycle lanes, multi-use urban trails are for pedestrians, slower moving bicycles, and other non-motorized modes of travel and are completely separated from roads by wide “green zones” and in some cases the road may not even be visible.

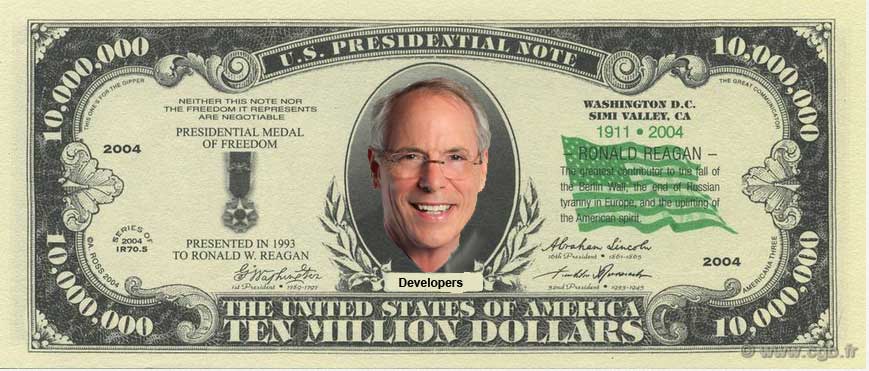

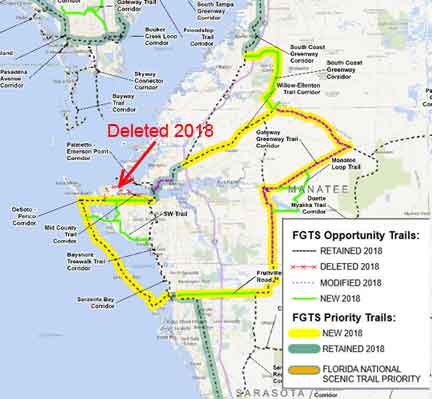

After blocking any trails in Manatee County for many years (other than in parks and preserves) the developers are suddenly interested and have managed to get an “eastern trail” on the list of priority trails for Manatee County and are trying to get our #1 trail deleted from the 2018 FGTS Priority Map.

For almost twenty years county residents have been advocating multi-use trails for safe and healthy exercise and commuting. Two comprehensive studies (2002 and 2013) recommended that the #1 priority trail should run between downtown Bradenton and Anna Maria Island generally paralleling the Manatee River.

The developers want it to run east of Interstate 75 and they are willing to donate some land to encourage the deal and make county officials jump at the opportunity. But, it really isn’t free because the trail would have to go through or by existing or planned developments thus enhancing developer land values. An eastern trail would have to cross several state highways including SR62, SR64 and SR70. And much of the trail would be routed under Florida Power and Light high-voltage electric lines, not exactly scenic views! And, when it gets to the Sarasota County line it ends.

It would be called the “Wilderness Trail” because much of it is out in (you guessed it) the wilderness, no shade, no water, no toilets, no stores or other services, nothing but scrub. To be fair, there are a few “nice” areas but this trail does not meet the minimum SUN Trail requirements to be safe, to be scenic, to have connectivity to points of interest, to serve the local and visiting populations, and to be ready for construction. If the Florida Greenways and Trails System wants a trail to bypass Manatee County and all its attractions then the Wilderness Trail is it.

On the other hand, the “Western Coastal Route” has it all. It connects many population centers in the County including Parish, Ellenton, Palmetto, the City of Bradenton, West and Northwest Bradenton, Holmes Beach, Bradenton Beach, and Longboat Key where it will connect to the Legacy Trail in Sarasota County. In addition, it connects points of interest including three preserves: Riverview Pointe Preserve, Robinson Preserve, and Perico Preserve. It is also mostly shady and most of the route is already owned by the County or is wide right-of-way.

On the other hand, the “Western Coastal Route” has it all. It connects many population centers in the County including Parish, Ellenton, Palmetto, the City of Bradenton, West and Northwest Bradenton, Holmes Beach, Bradenton Beach, and Longboat Key where it will connect to the Legacy Trail in Sarasota County. In addition, it connects points of interest including three preserves: Riverview Pointe Preserve, Robinson Preserve, and Perico Preserve. It is also mostly shady and most of the route is already owned by the County or is wide right-of-way.

Points of interest along the route include the Railroad Museum, Gamble Plantation Historic State Park, Emerson Point Preserve, Palmetto Historical Park, Riverwalk, South Florida Museum, Old Main Street (Bradenton), Desoto Memorial, Palma Sola Botanical Park, three preserves (Riverview Pointe, Robinson, Perico), and two public beaches (Manatee County Beach and Coquina Beach) directly on the Gulf of Mexico.

There are numerous public restrooms already in place along the way with water fountains, benches, shady picnic tables, and even a camp ground in Robinson Preserve. This all means lower cost.

Parts of the Coastal Route are already “shovel ready” including the western edge of Perico Preserve and the northern portion of Robinson Preserve along the Manatee River.

The Cities of Palmetto, Holmes Beach, and Bradenton Beach are already committed. They realize that most of the funding for this trail will be provided by FGTS and local investment will return as much as 9 to 1 on that investment. For every $1 invested, the community will earn $9 according to the Florida Greenways and Trails, Foundation.

The City of Bradenton probably has the most to gain because the trail will provide easy commuter access to downtown areas via bicycle and foot which is almost impossible now because of SR64 (Manatee Ave.) and the Wares Creek bridge are a dangerous choke point. This western trail will not have to cross any major roads and because it will parallel the river there will be very few cross-streets.

And, the Coastal Trail will provide the backbone of a trail network serving at least nine schools, numerous neighborhoods, and other trails already in the county master plan especially trails that will service our less fortunate citizens who depend on bicycles to get to work and home again.

To squelch the Gulf Coast Trail, the developers have influenced the MPO to “Delete 2018” the portion of the trail running along the Manatee River in the City of Bradenton, west and northwest Bradenton as indicated on the DRAFT copy of the “FGTS Opportunity and Priority Trails Map”. Instead, the County has substituted a one-mile-wide “swath” along Manatee Avenue that will be “studied” for a possible future route which is nonsense since we already have two comprehensive studies. Those two studies (2002 and 2013) both recommend the Riverview-Robinson Preserve route, why would our MPO request that our trail be “Deleted 2018” so they could do yet another study? Click HERE to see the map provided by the Sarasota-Manatee MPO. Note the red X's on the DRAFT Plan (2nd page).

Obviously, the deletion is a thinly veiled effort by the developers to take the Gulf Coast Trail out of consideration.  They want the SUN Trail to go out east because it will increase the value of their property and be one more amenity to entice home buyers. It is ironic that the developers vehemently opposed any trails in Manatee County for over twenty years because it would increase impact fees and now they favor them. Well, they were successful. Manatee County has zero miles of multi-use trails except those in parks and preserves.

They want the SUN Trail to go out east because it will increase the value of their property and be one more amenity to entice home buyers. It is ironic that the developers vehemently opposed any trails in Manatee County for over twenty years because it would increase impact fees and now they favor them. Well, they were successful. Manatee County has zero miles of multi-use trails except those in parks and preserves.

All our neighbor counties have extensive trail systems and a dedicated bicycle/pedestrian trail coordinator. Manatee County has none but now that the State is providing funding, developers want the trails so they can make more money but they only want them if they go east of the Interstate where most of the new development is.

We need to tell Florida Greenways and Trails that we want, need, and deserve the SUN Trail to take the western route along the Gulf Coast. Please help by doing one of the following:

1) - Attend a Public Workshop in North Port on October 26 (Thurs.) at the:

Morgan Family Community Center

Meeting Room A/B

6207 West Price Blvd.

North Port, FL 34291

4:00-7:00 ET

If you would like to attend’ email OurManateeCounty@gmail.com for carpool information.

2) - Click on the link below and fill out the form and mail it in:

FGTSPlanCommentForm REVISED blank.docx

3) -Email Samantha Browne at:

samantha.browne@dep.state.fl.us

How ever you decide to send your ideas, please make sure you mention that you are in favor of the “Western Coastal Route for the SUN Trail along Riverview Blvd. in Manatee County”. Make sure you tell Ms. Browne why you favor that route.

Please take a few minutes to help stop the developers from taking our trail away. We need and deserve it. The only way we can get this trail is if many people in Manatee County let Florida Greenways and Trails know what we want. Please write to Ms. Browne. samantha.browne@dep.state.fl.us

The article above was produced by “Friends of Manatee Trails”

https://www.facebook.com/manateetrails

THE COUNTY NEEDS TO PROTECT US

September 27, 2017

On September 11, 2017 Hurricane Irma’s eye passed east of Manatee County as a category 1 storm. Hurricane force winds from the north downed hundreds of trees, removed roofs, and cut electricity to most of the county. The 75+ mph winds from the north emptied Palma Sola Bay.

Had the hurricane turned later as predicted and come up the west coast of Florida it would have been devastating for Manatee County. With counterclockwise winds, Irma could have produced a storm surge of 10’ or more as winds of well over 100 mph from the south  pushed water into Palma Sola Bay. NW Bradenton would have been inundated as the storm water surged through neighborhoods crossing from Palma Sola Bay over to the Mantatee River and then again into Snead Island and Palmetto. Further south, water would have been funneled into Sarasota Bay and would have surged into Bayshore Gardens, Long Bar Point, and Tidy Island. Longboat Key, Cortez, and Anna Maria Island would also have been inundated as the storm moved north and the winds shifted more westerly pushing seawater up the Manatee and Braden Rivers causing high storm surges well inland.

pushed water into Palma Sola Bay. NW Bradenton would have been inundated as the storm water surged through neighborhoods crossing from Palma Sola Bay over to the Mantatee River and then again into Snead Island and Palmetto. Further south, water would have been funneled into Sarasota Bay and would have surged into Bayshore Gardens, Long Bar Point, and Tidy Island. Longboat Key, Cortez, and Anna Maria Island would also have been inundated as the storm moved north and the winds shifted more westerly pushing seawater up the Manatee and Braden Rivers causing high storm surges well inland.

Yes, we were very lucky but we can’t depend on luck to save us. We must stop ignoring FEMA predictions and start controlling construction in coastal areas. Keep in mind that predictions are based on only Category 1 hurricanes and that our (Florida West Coast) peak hurricane season is October and November when storms originate in the Caribbean where the water temperature is still in the 90’s.

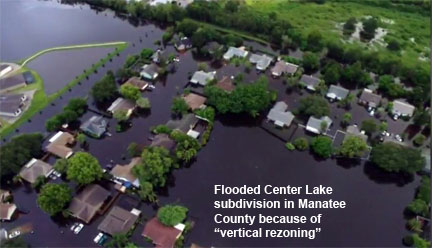

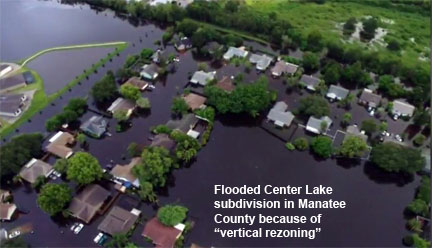

Developers use the term “vertical re-zoning” to describe filling in low areas to bring them up from Coastal High Hazard Areas to higher flood evacuation zones. The problem is that by developing that land they decrease the amount of permeable land by covering it with buildings, roads, parking lots, driveways, sidewalk, etc. The result is faster runoff thus flooding now-lower surrounding areas. A good example is the Center Lake neighborhood here in Manatee County that was totally flooded in August by a heavy rain storm because surrounding developments had elevated the land. http://wfla.com/2017/08/28/centre-lake-neighborhood-submerged-homeowners-dealing-with-ongoing-nightmare/

Tides End a new Neal development under construction in NW Bradenton brought in thousands of truckloads of fill to bring that property up out of the Coastal High Hazard Area. Time will tell what destruction that will have on nearby neighborhoods. http://www.heraldtribune.com/news/20161006/commissioners-ok-tides-end-38-home-neal-subdivision

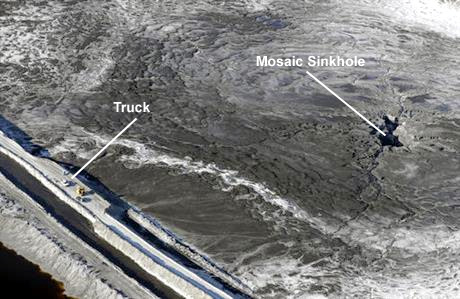

Now Carlos Beruff wants to elevate his Long Bar Pointe property called Aqua by the Bay to keep it safe from storm surges and rising sea level. We can predict what will happen to Tidy Island, Legends Bay, and other nearby neighborhoods in the event of a storm surge that is sure to come eventually, probably long after the developer has banked his profit and departed to wreak havoc on other low-lying areas.

Yes, it is the responsibility for the county to protect its citizens. Let’s hope they start doing that soon.

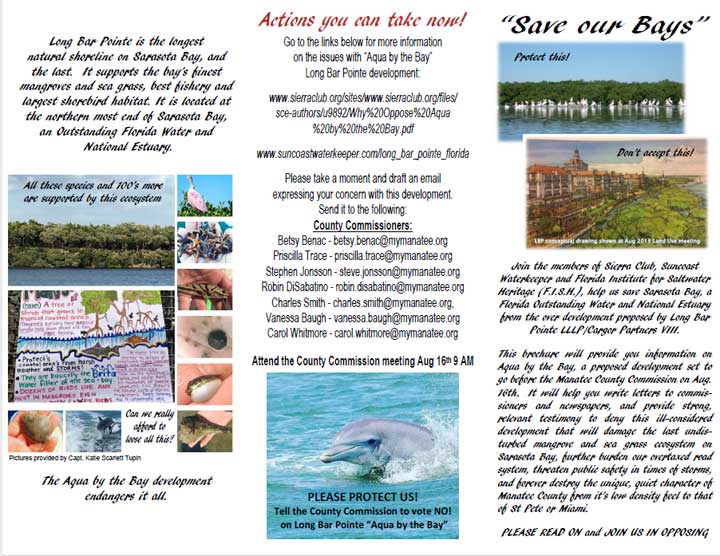

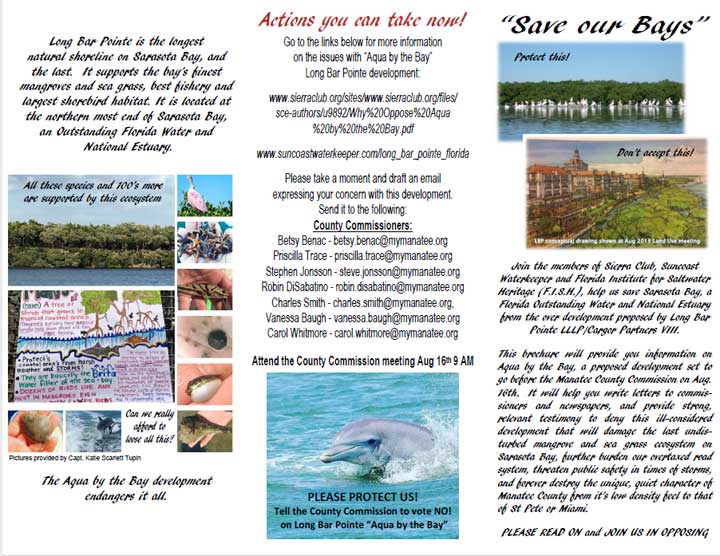

WE MUST STOP CARLOS BERUFF FROM DESTROYING SARASOTA BAY

July 19, 2017

Read and share the brochure below. It is full of things you can do to stop destruction of our beautiful bay. Beruff wants a marina that will accommodate hundreds of boats. Those boats will destroy the seagrass that took twenty years and millions of dollars to restore. His proposed canal and huge cement seawall will deflect water that will destroy the mangrove forest along the shore and in the event of a storm it will cause flooding of areas north and south of his ill conceived development. He must not be allowed to violate our comprehensive plan. Get involved to help stop him from changing our shoreline forever. Click this link to open a full sized and printable copy of this brochure.

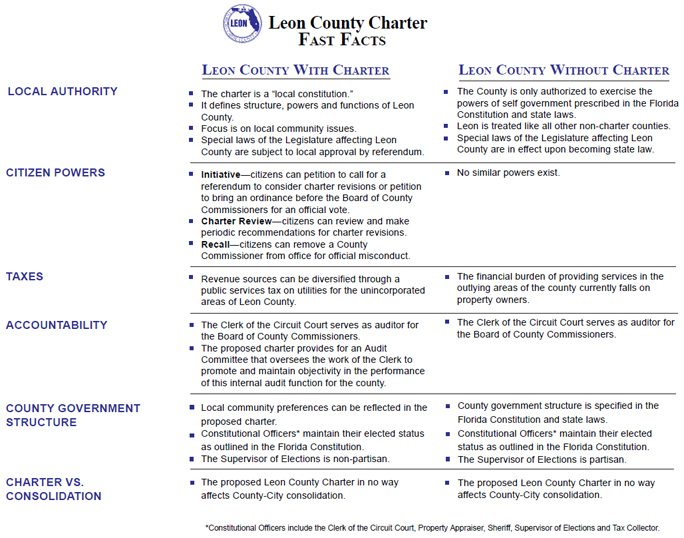

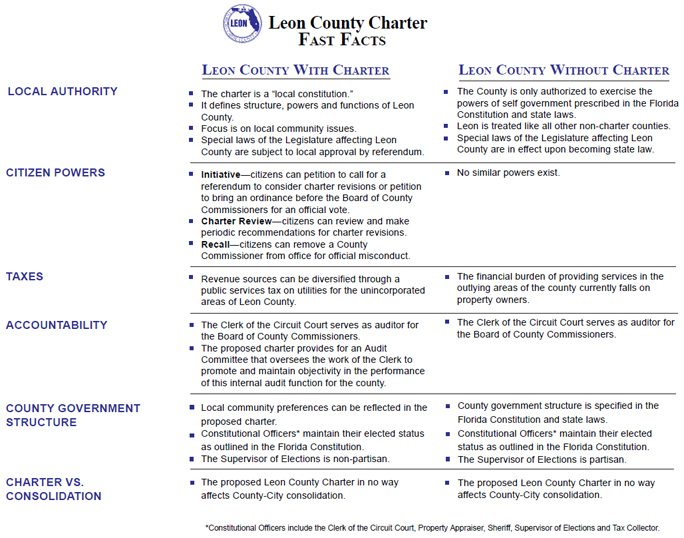

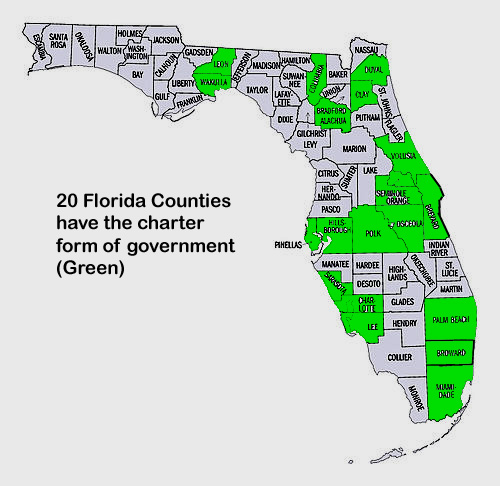

LEON COUNTY CHARTER GOOD EXAMPLE FOR MANATEE COUNTY

July 4, 2017

On November 5, 2002, the citizens of Leon County approved making it a “Home Rule Charter” county. The charter, which is the county's constitution provides citizens more direct participation in county government. Specific citizen powers outlined in the charter include:

Initiative – Citizens can petition to call for a referendum to consider charter revisions or petition to bring an ordinance before the Board of County Commissioners for an official vote.

Charter Review – Citizens can review and make recommendations for charter revisions.

Recall – Citizens can remove a commissioner from office for official misconduct.

Below are "Fast Facts" charter advocates produced to help inform Leon County electors before the vote.

Click here for a PDF copy of these Leon County "Charter Fast Facts".

Click here to see and print the petition for charter government in Manatee County. (2 copies, 1 for you and 1 for a friend)

AQUA BY THE BAY IGNORS CONCERNS OF NEIGHBORS, ENVIRONMENTAL CONSULTANTS

Stuart Smith - For Suncoast Waterkeeper and Sierra Club

June 26, 2017

Developer Carlos Beruff’s scheme to build a linear lagoon and seawall 2½ miles long just behind the mangroves at Aqua by the Bay on Long Bar Pointe endangers nearby neighbors and the Outstanding Florida Waters of Sarasota Bay, but he does not seem to be concerned.

Tidy Island, with 96 homes directly west of Aqua by the Bay, lies in the path of any storm surge reflected off the seawall. Mr. Beruff also plans to make the lagoon part of his stormwater system, routing runoff to the lagoon then letting it drain into the bay. But his team has no idea how or if it will work.

Tidy Island, with 96 homes directly west of Aqua by the Bay, lies in the path of any storm surge reflected off the seawall. Mr. Beruff also plans to make the lagoon part of his stormwater system, routing runoff to the lagoon then letting it drain into the bay. But his team has no idea how or if it will work.

The system could well exacerbate the inevitable decline of the mangroves, deprived by the seawall and lagoon of the natural flow of upland sediments which ordinarily restore the soils swept away by every tide.

A weakened forest would compromise storm surge protection for Aqua by the Bay and increase wave reflection from the seawall toward Tidy Island, cutting the causeway which is the only access to the community, making it impossible for residents to evacuate or to return after a storm, and violating Comprehensive Plan provisions 4.3 and 3.3.1 that protect coastal residents from natural disaster. Mr. Beruff has done no storm surge studies.

CB&I, a consultant hired by Manatee County to study the lagoon, said unknown tidal flows could make the lagoon stagnate, not a pleasant prospect for residents of Aqua by the Bay, or rush through the mangroves “undermining the foundation and root systems” and even “adversely impacting seagrass beds.”

CB&I recommended a flushing study more than a year ago. Mr. Beruff has yet to do one. To see complete CB&I Report CLICK HERE.

100% IMPACT FEES = NO PROPERTY TAX INCREASE

June 22, 2017

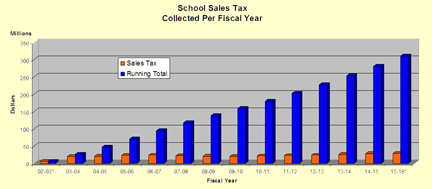

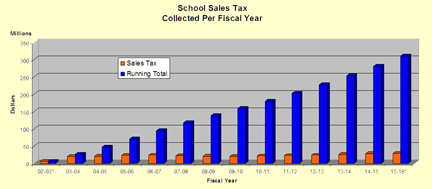

It is all about money and education. Years ago, the developers realized that both sales tax revenue and impact fee revenue could be used to construct new schools, buy new school buses, add more classrooms to existing schools, and numerous other capital expenditures for the school district. That is why they were so anxious in 2002 to promote the original school sales tax and the 2016 vote to extend it another 15 years.

It is all about money and education. Years ago, the developers realized that both sales tax revenue and impact fee revenue could be used to construct new schools, buy new school buses, add more classrooms to existing schools, and numerous other capital expenditures for the school district. That is why they were so anxious in 2002 to promote the original school sales tax and the 2016 vote to extend it another 15 years.

The developers plan was, and still is, to use as much of the sales tax revenue as possible for capital expenditures required by new development thus making it look like collecting the full 100% impact fee was/is not needed and should not be charged.

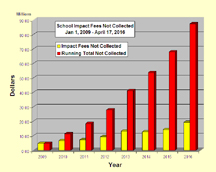

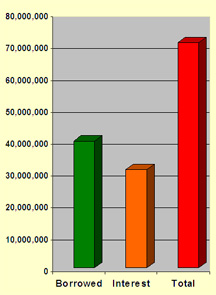

What they don’t tell you is that their scheme produces a shortfall in funding for non-new-development-required infrastructure. That is why some of our schools have deteriorated and why we have so many sub-standard portable classrooms, and outdated equipment to name a few. And that is why the school district just borrower $150,000,000 which we will have to pay back plus interest one way or another.

If the school district had been collecting the full 100% impact fees since 2008 we would not be in our present budgetary situation.

The developers, by manipulating elections and county employees, were able to orchestrate the complete suspension of school impact fees for seven-and-a-half years and get huge impact fee discounts for the past two years thus reducing school revenue by over $100,000.000 while keeping that same amount in their pockets. It is no wonder that they have a lot of cash to support their hand-picked candidates and to promote the sales tax. They are using OUR money and now they want more.

If the School Board is successful in having property taxes increased we should say good-by to the developers ever paying what they owe in impact fees which is 100% of what the impact fee study recommends.

There is a better way. Last year, 2016, residential property owners paid three different school sales taxes as follows:

SCHOOL BOARD REQUIRED EFFORT – 4.6720 mills

SCHOOL BOARD BASIC DISCRETIONARY – 0.7480 mills

SCHOOL BOARD CAPITL IMPROVEMENT – 1.500 mills

Total School Property Tax – 6.9200 mills

That equates to a tax of $6.92/ $1000 of your house assessment less the homestead exemption of $25K. A house assessed for $300K last year paid a school sales tax of $1,903. If the 1 mil increase is approved, the new tax for that same house will be $2,178 plus the increase in assessment which is capped at 3%. That works out to $2,249, a tax increase of $346.28.

The State allows other school taxes that require voter approval. The School Board could propose a referendum that increased the millage by 0.5 mills and at the same time reduced the “Capital Improvement” tax by the same amount, 0.5 mills. The total school millage would remain unchanged at 6.92 mills.

With increased revenue from the continuing sales tax and School Impact Fees set at 100% there should be no shortage of funds for “Capital Improvements”.

The bottom line is that under this plan, there is no need to increase school property tax and still increase teacher compensation..

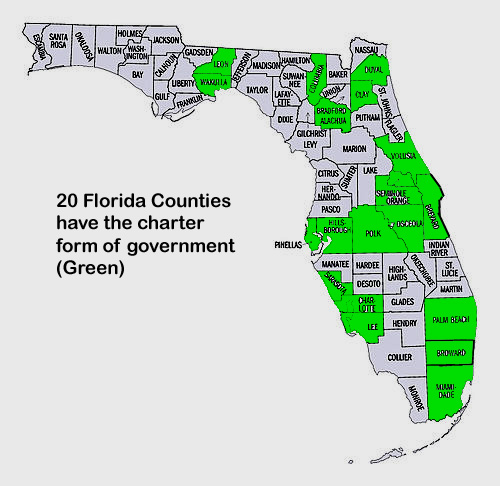

HOME RULE = CHARTER GOVERNMENT

Revised May 29, 2017

With a Charter, the county may change the way it is structured and how it functions to meet the needs of the county without having to go to the legislature for permission.

With a Charter, the county may change the way it is structured and how it functions to meet the needs of the county without having to go to the legislature for permission.

There are two types of county government in Florida: non-charter government and charter government. Sections 1(f) and (g), Art. VIII of the State Constitution, respectively provide:

Non-Charter Government: Counties not operating under county charters have powers of self-government that are provided by general and/or special law. The board of county commissioners for the non-charter counties may enact, in a manner prescribed by general law, county ordinances that are not inconsistent with general or special law, but an ordinance in conflict with a municipal ordinance shall not be effective within the municipality to the extent of such conflict.

Charter Government: Counties operating under county charters shall have all powers of local self-government not inconsistent with general law, or with special law approved by vote of the electors. The governing body of a county operating under a charter may enact county ordinances not inconsistent with general law. The charter shall provide which shall prevail in the event of conflict between county and municipal ordinances.

The county and its cities also have more flexibility for ways to collaborate. Much is being made by the cities of a potential county "takeover" of their prerogatives. In actuality, the charter counties work with the cities better, because they have more options. Try doing a search for articles about Florida charter counties- conflicts with their cities due to county preemption of the city's ordinances. You get zero. What you do get though, is tons of articles about the state legislature pre-empting both city and county authorities.

Citizen Advantages

- Lower taxes – will not be subsidizing interest groups

- Lower taxes – will be charging full cost of services (new cost of services study required)

- Less influence by interest groups in elections – lower campaign contributions/person (company)

- Better life style – Tax revenue will be used to improve quality of life – ex. Multi-use trails

- Better Schools – Teacher pay will increase since impact fees will be 100%

- Streets and other County facilities better maintained – closer control on spending

- Elections fairer – redistricting to not favor any party or candidate

- Citizens able to amend Charter

- Citizens able to introduce referendums in elections

- Less State interference in local government

- More control of Planning Commission – change method of member selection and retention

- More control of Board of Commissioners – term limits

- More control of Board of Commissioners – recall (may be fired)

- More control of Board of Commissioners – number of commissioners and representation determined by referendum

- More control of County Department Heads

- Recall of officials who violate rules

- Ability to enact term limits of elected officials

- Some positions currently appointed could be made elected positions, e.g. county manager, planning and charter commissioners

- Campaign contribution limits for candidates in local elections

- Limits on interest group contact with Board members – Board appointment calendar made public

- More control of environmental impacts – Enforce restrictions

- Better adherence to Comprehensive Plan – require super majority Board vote for exceptions

- 100% collection of impact fees (county & school) required unless approved by referendum

- No bond issues over $30M (or other amount) without referendum

- Reduce the debt with goal of “pay-as-you-go”

- RFP’s (Request for Proposal) required for most County and School District contracts

- No FIF’s (Facility Investment Fees) instead of impact fees

These are some possibilities. The initial charter would be a “starter charter” that would include the most popular items. Later as the need becomes apparent, new items could be added (or rejected) through referendums on ballots during regular elections (no additional cost)

BoCC Advantages

There are also significant advantages for our elected officials. We often see our Board of Commissioners struggle with decisions because State Laws don’t address all situations. Many of those common issues could be written into the charter so there would be no need for further debate. This would lead to:

- Less controversial decision making by elected officials since the charter would spell out local law unlike State law

- Reduction in State interference in local decisions

- The State legislature would spend less time dealing with a multitude of local issues

- Amendments to the charter are relatively easy to put on the ballot by the Board and citizens

- Elections could be less political if party affiliation was not required for candidate

- There would be less pressure from interest groups on elected officials since many issues could be settled by referendum

Again, this is just a short list. There are numerous pros and cons which need to be reviewed and debated before the Board of Commissioners would authorize formation of a charter commission. Also, Florida Statute 125-61, upon the submission of a petition to the county commission signed by at least 15 percent of the qualified electors of the county requesting that a charter commission be established, a charter commission shall be appointed pursuant to subsection (2) within 30 days of the adoption of said resolution or of the filing of said petition.

On June 14th from 6:00 – 9:00 PM the Board of County Commissioners will meet at the Convention Center in Palmetto to discuss “Charter Governments”. The public will have an opportunity to speak.

Background on a Previous Attempt at Charter Government

In 2002 there was an attempt to form a charter government in Manatee County. That attempt was unpopular primarily because a “proposed” charter put too much control in the hands of the county at the expense of the incorporated municipalities, the cities and towns in Manatee County. That “Charter” was not official and was not written by a charter committee as required by the State Constitution, and was never voted no by the people of Manatee County.

As a compromise a document known as “The Accord” was composed and agreed upon by various incorporated governments in the County. “The Accord” may be seen at http://ourmanatee.com/Accord.pdf This document became a “General Interlocal Agreement” with the County and Municipalities that signed it. It is not and was not a charter. The Accord is still in effect but does not hold the weight of a charter.

As reported in the SUN, 20 of the 67 counties in Florida already have charter governments. ALL the incorporated areas (cities and towns) in Manatee County have charter governments. Over 75% of ALL residents of Florida live under charter governments.

The term charter government is derived from the fact that the document that outlines the “rules” of the local government is called a “charter”. Another term used for “charter government” is “home rule”.

A TALE OF TWO TRAILS

February 18, 2017

Click on map for larger image.

Once upon a time there was a county in Florida called “Manatee”. It was a wonderful place to live with many gifts from nature including miles of sugar white beaches, a beautiful wide river, abundant wildlife including numerous species of native and migratory birds, and a large verity of tropical and subtropical vegetation. The fishing is fantastic both saltwater and fresh.